http://www.break.com/embed/1?embed=1

Arizona’s Marijuana Tax Revenue Milestone: A Closer Look

Arizona’s impressive achievement of collecting nearly $25 million in marijuana tax revenue for February has sparked a lively debate among policymakers, community advocates, and industry experts alike. With the state nearing the nearly $1 billion mark in cumulative tax revenue since legalizing recreational marijuana, there is much to unpack behind these figures. In this opinion editorial, we take a closer look at the factors that have driven this growth, the distribution channels of the funds, and the broader implications for public policy and community welfare in Arizona.

The latest figures, released by the Arizona Department of Revenue, show that in February alone, tax revenue from licensed marijuana sales reached a total of $24,957,632. This represents an increase of approximately 9% compared to the same month in the previous year. For many observers, these numbers signify more than just economic gains—they reveal a story of how a state can turn a challenging legislative change into tangible benefits for local communities.

Breaking Down the Revenue Figures

At first glance, the revenue numbers might seem straightforward, but when you dive in, there are several tricky parts and tangled issues that deserve attention. The tax proceeds come from three main sources:

- Recreational marijuana excise tax (16%): $15,501,746

- Adult-use tax (5.6%): $7,953,363

- Medical marijuana tax revenue: $1,501,359

This breakdown shows that while recreational marijuana sales generate the lion’s share of tax revenue, adult-use and medical dispensaries also play an important role. Each category has distinct rules and rates, which contribute to the overall stability of the revenue flow. Understanding these individual components provides a clearer picture of the state’s fiscal health and its potential to address pressing community needs.

Below is a table summarizing the revenue sources:

| Revenue Source | Tax Rate | Amount Collected |

|---|---|---|

| Recreational Marijuana Excise | 16% | $15,501,746 |

| Adult-Use Tax | 5.6% | $7,953,363 |

| Medical Marijuana Tax | — | $1,501,359 |

This visual breakdown helps to clearly understand where the funds are coming from and highlights the significance of the recreational marijuana segment in major revenue generation.

Impact on Public Services: The Allocation of Funds

One of the most debated aspects of marijuana tax revenue is how the funds are distributed across various public sectors. Arizona’s policy is structured to ensure that these dollars support community welfare and critical public services. The allocation strategy is as follows:

- 33% to Community College Districts

- 31.4% to Local Law Enforcement and Fire Departments

- 25.4% to the Arizona Highway User Revenue Fund

- 10% to the Justice Reinvestment Fund, which supports public safety, health, and drug treatment programs

- 0.2% to the Attorney General for enforcement costs

This arrangement is designed with several key goals in mind. By directing a significant portion of the revenue to community colleges, Arizona ensures that education remains a cornerstone of growth and opportunity. Similarly, bolstering law enforcement and fire departments with over 31% of the funds addresses the essential need for public safety. The allocation to the Highway User Revenue Fund is another clever move, tying revenue to infrastructure improvements that benefit all citizens.

However, as with any allocation plan, there are some complicated pieces that require further discussion. Critics argue that the percentages allocated to certain areas—particularly those related to law enforcement and infrastructure—might not fully address the burgeoning needs within the cannabis industry itself, especially in areas of regulatory oversight and public health education. Nonetheless, such a distribution underscores the state’s decision to invest in broad-based community improvements rather than channeling too much revenue into one single sector.

Legal and Policy Backdrop: The Road to Legalization

In November 2020, Arizona voters overwhelmingly approved the legalization of recreational marijuana, opening the door for licensed sale and distribution. This landmark decision was part of a broader national trend toward reshaping drug policies and reducing penalties associated with marijuana use. The legislative journey was not without its nerve-racking twists and turns, as stakeholders from all walks of life debated the potential benefits and pitfalls of legalization.

Many experts noted at the time that legalizing marijuana could be a risky policy move, loaded with issues and subtle details that needed careful management. Some were concerned about the social implications, while others focused on the anticipated surge in tax revenue. The state’s confident approach in allocating the revenue to improve community facilities and public services was seen as a clever way to balance these competing interests.

The debate at the ballot box was intense, with voters closely examining the fine points of the proposed tax revenues and spending plans. Despite the intimidating challenges posed by the existing federal legal environment, Arizona’s decision to legislate marijuana use for recreational purposes turned out to be a super important stepping stone toward modernizing its public finance strategy. The outcome is now clear in the substantial revenue collected and its wide-reaching community benefits.

Growth Trends and Economic Opportunities in Detail

Arizona has witnessed steady growth in its marijuana tax revenue since legalization, with the latest figures marking a notable leap forward. The increase of about 9% from February of the previous year suggests a positive momentum for the industry. This growth is not without its confusing bits, particularly as the market adjusts to regulatory changes, consumer behavior modifications, and evolving competitive dynamics.

One of the most significant opportunities lies in the potential for continued economic expansion. As more local businesses become licensed operators, there is room for job creation, increased tax compliance, and a thriving ancillary market comprising security, technology, and logistics. With nearly a billion dollars collected in cumulative revenue, Arizona is positioned to reinvest in local communities and promote equitable economic development.

That said, there are a few tangled issues that the state must handle. For instance, the pace at which infrastructure and public service improvements roll out can have a direct correlation with taxpayer satisfaction. Should the distribution of funds appear uneven or misaligned with public expectations, it may lead to growing tensions between the state government and local communities. Therefore, the key for policymakers is to keep a close eye on how these funds are spent and to maintain a clear line of communication with the public regarding the use of these resources.

The Broader Implications for State and Local Governments

The staggering sum collected from marijuana taxes poses a compelling case study for other states that are considering similar legislative actions. Arizona’s approach demonstrates that when a state is committed to transparency and public accountability in fund allocation, it is possible to create a win-win scenario. Local governments, in particular, are now grappling with the task of finding their way through the administrative and financial nuances tied to this new revenue stream.

Policymakers in Arizona have every reason to feel encouraged by the success of the marijuana tax revenue system. However, it is equally important to dig into the challenges that lie ahead. For one, the state needs to manage expectations about how quickly improvements can be seen in community services. Stakeholders have pointed out that while revenue figures are impressive, the implementation of programs benefiting education, public safety, and infrastructure may encounter unexpected delays or administrative headaches.

Here are some of the small distinctions that state officials and local administrators need to consider:

- Timely Program Execution: Ensuring that funds are disbursed quickly can help lessen community tensions and improve the public perception of the new tax policies.

- Transparency in Spending: Regular public reports that detail where and how the money is spent can help maintain trust among residents.

- Responsive Public Services: Allocating funds effectively means being prepared for unexpected shifts in public needs, especially as the cannabis industry matures.

- Regulatory Oversight: Strengthening the oversight mechanisms to monitor how licensed marijuana businesses comply with state regulations is critical for long-term success.

The findings so far suggest that Arizona’s approach—while not perfect—has laid a solid foundation for further progress. The lessons learned here could provide a blueprint for other states contemplating their path through the maze of cannabis legalization and tax revenue management.

Community Perspectives: Weighing the Pros and Cons

Beyond the fiscal numbers and policy debates, the human element of this story cannot be overlooked. Community members across Arizona have expressed both optimism and some reservations regarding the rapid changes in marijuana policy and tax revenue allocation. While many see a clear benefit from increased funding for education, law enforcement, and infrastructure, others worry about the social implications and potential gaps in regulatory enforcement.

For instance, some local residents feel that the funds allocated to community colleges are an essential investment in the future, enhancing workforce skills and promoting economic mobility. Meanwhile, supporters of enhanced law enforcement funding argue that bolstering local safety services can help mitigate any negative social behaviors associated with increased marijuana use. Critics, however, point to the perceived imbalance in spending, questioning why more funds are not channeled toward public health and community outreach specifically designed to educate citizens on responsible consumption.

These differing viewpoints emphasize the importance of maintaining a dialogue between government agencies and local communities. A more inclusive debate that takes on board the concerns of all stakeholders can help to smooth over the nerve-racking twists and turns inherent in adapting to any new fiscal landscape.

Comparative Views on Marijuana Revenue Across U.S. States

Arizona’s experience with marijuana taxation is not happening in a vacuum. In fact, it presents an interesting contrast with developments seen in other states that have also moved to legalize recreational marijuana. Several states have reported similar successes in tax collection, but the specific breakdowns and policy priorities can vary widely depending on local needs and political philosophies.

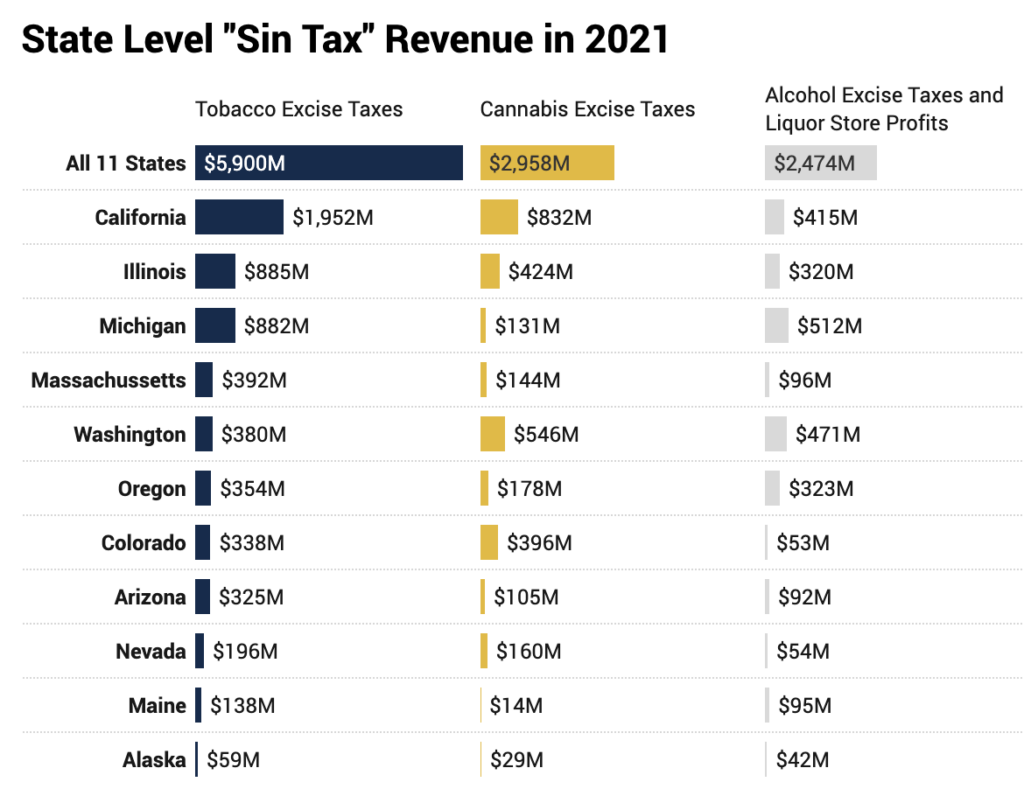

When looking at reports from states like California and Colorado, it becomes apparent that while the growth in tax revenue is a shared narrative, the way funds are allocated often reflects different community priorities. For example:

- California: Has placed a heavier emphasis on funding social programs and environmental initiatives.

- Colorado: Often focuses on public health initiatives, including substance abuse programs, along with general infrastructure improvements.

These comparisons underline that there is no one-size-fits-all approach. What works well in Arizona, with its particular mix of revenue allocation and community priorities, might require adjustments when applied in another state with a different socioeconomic profile. The subtle details of each policy framework need to be scrutinized, as local governments work hard to find their way through the challenges of integrating new tax revenue sources into their broader budgets.

Importantly, as states share data and best practices, there is an opportunity for collaborative improvement. By studying the successes and minor missteps of states like Arizona, policymakers nationwide can steer through the complicated pieces of legal cannabis operations and design their programs accordingly.

Potential Pitfalls and Considerations Moving Forward

Despite the promising figures and the generally positive reception, the path forward is not without its tricky parts and nerve-racking challenges. Several concerns remain on the table as Arizona and other states continue to work through the tangled issues related to marijuana taxation:

- Regulatory Enforcement: Ensuring that licensed businesses adhere to state laws is a continuous challenge. Without proper oversight, the system risks becoming less effective over time.

- Economic Volatility: As with any emerging market, fluctuations in consumer demand and external economic factors can lead to unpredictable changes in tax revenues.

- Public Perception: As tax dollars are reinvested in various public services, it is essential that residents are kept informed about how their money is being used. Transparent communication can help ease public concerns about potential misuse of funds.

- Integration with Federal Law: Federal policies on marijuana remain on edge, and any shifts at that level may have direct implications for state programs. Navigating these small distinctions between state and federal guidelines will require ongoing attention.

These issues are not insurmountable. In fact, they represent common challenges that require persistence, detailed planning, and a willingness to adjust priorities based on evolving circumstances. As Arizona continues to collect and allocate marijuana tax revenue, the lessons learned from both successes and setbacks will be invaluable for future policy formulation.

The Future of Marijuana Tax Revenue: Growth and Community Investment

Looking ahead, there is a strong case to be made that Arizona’s model for marijuana tax revenue could serve as a template for achieving balanced community investment. The super important aspect here is that the revenue is used not only to boost state coffers but also to directly benefit the everyday lives of residents. From funding community colleges to enhancing public safety and maintaining crucial infrastructure, the potential for positive change is significant.

However, for this revenue to be truly transformative, policymakers must be adept at tackling the hidden complexities of fund management. Here are a few recommendations for ensuring that the benefits continue to roll in:

- Enhanced Transparency: Regular oversight and public reporting can help demystify the allocation process, allowing the community to track progress and hold officials accountable.

- Responsive Governance: State and local governments should remain agile in adjusting funding priorities as new issues emerge—whether those be advancements in microeconomic conditions or shifts in public safety needs.

- Robust Stakeholder Engagement: Establishing regular forums for community input can ensure that the voice of the public is heard, helping to balance technical budget planning with grassroots priorities.

- Continuous Evaluation: Monitoring the effectiveness of spending initiatives and making adjustments based on performance data will be key to sustaining long-term growth and community well-being.

These measures are not only critical for safeguarding the integrity of Arizona’s tax revenue system but are also designed to foster a culture of accountability that resonates with voters and community members alike.

Public Opinion and the Human Aspect

Beyond the numbers and fiscal analyses, the public opinion in Arizona regarding the recent marijuana tax revenue surges is mixed, reflecting diverse experiences and expectations. Some community members celebrate the additional funds as a necessary investment in critical public services, while others caution that behind the apparent success lies a maze of administrative hurdles and unintended consequences.

For many, the increased revenue represents a hopeful shift toward improved infrastructure, better-funded education programs, and enhanced public safety measures. On the flip side, skeptics express concerns over whether the funds will be spent in a manner that truly reflects community needs. This ambivalence underscores the fact that financial success alone is not sufficient to satisfy all stakeholders—it is how that success is translated into tangible benefits that ultimately matters.

The debate surrounding marijuana tax revenue brings to light several of the little details that often get overlooked. Critics argue that while the revenue numbers are impressive, there exists a need for ongoing assessments to ensure that the allocation of these funds meets the nuanced requirements of every community sector. As public trust is built or eroded over time, maintaining a balance between economic growth and equally addressing the small twists of day-to-day public service demands will be a continual process.

Learning from Experience: Policy Lessons for Other States

Arizona’s experience offers several key lessons for other states contemplating similar legislative changes regarding marijuana legalization and taxation. Although each state’s political landscape and economic conditions are unique, the Arizona model demonstrates important strategies for overcoming both the confusing bits and the intimidating challenges that often accompany major policy shifts.

For states still debating legalization, here’s a summary of the critical takeaways from Arizona’s approach:

| Key Lesson | Implication |

|---|---|

| Holistic Fund Allocation | Design revenue distribution to benefit a wide range of public services, from education to public safety. |

| Transparent Communication | Keep the public informed about how funds are spent, building trust and accountability. |

| Responsive Policy Making | Adapt funding allocations as market conditions and public needs change. |

| Rigid Oversight Mechanisms | Ensure strict adherence to regulations to prevent misuse and maintain system integrity. |

These pointers suggest that while the economic benefits of marijuana taxation are evident, the key to long-term sustainability lies in a balanced and community-oriented approach. For policymakers everywhere, the Arizona example offers both inspiration and a cautionary tale—a reminder that success depends not just on collecting revenue, but on making your way through the administrative twists and turns that follow.

Looking Ahead: Balancing Revenue Growth with Community Well-Being

As Arizona continues to record robust marijuana tax revenue, state officials and community leaders are tasked with the nerve-racking responsibility of ensuring that every dollar is spent in ways that promote broad-based prosperity. The challenge lies in finding your way through ever-changing market conditions, legislative amendments, and public expectations—all while steering through the detailed components of fund allocation and program implementation.

The debate over marijuana revenue is not solely about fiscal success; it also represents a larger conversation about social justice, community investment, and the role of government in fostering a more inclusive economy. With nearly $1 billion collected so far, there is a significant opportunity to address longstanding issues in education, public safety, and infrastructure—provided these funds are managed with foresight and a commitment to transparency.

As we look to the future, several questions remain:

- How will Arizona continue to support its spending priorities as the market evolves?

- What steps will be taken to ensure that the hidden complexities of marijuana regulation do not derail progress?

- How can local governments best harness this revenue to create meaningful, lasting improvements for their communities?

- What safeguards can be introduced to ensure that increased revenue translates into tangible benefits for all residents?

These questions demand thoughtful responses from both policymakers and community advocates. The answers will not only influence the ongoing development of Arizona’s cannabis industry but may well inform future legislative efforts in other states considering similar models.

Conclusion: A Model Worth Watching

In summing up, Arizona’s leap to nearly $25 million in marijuana tax revenue for February—and a cumulative total that nears $1 billion—marks a significant milestone in the state’s journey towards modernizing its public finance system. While there are tangled issues and a few confusing bits to sort out, the overall picture is one of cautious optimism, balanced by the need for detailed oversight and transparent fiscal management.

The rollout of marijuana legalization in Arizona has not only generated significant economic activity but has also begun to reshape local communities by investing in essential public services. As debate continues and as the state works through the trickier parts of fund allocation and regulatory enforcement, one thing is clear: the success of this venture depends on a sustained collaborative effort between government officials, community stakeholders, and industry experts.

Ultimately, Arizona’s experience serves as a potent reminder for other states that the benefits of marijuana legalization are many—but realizing those benefits requires steady hands at the wheel, clear communication, and an ongoing commitment to ensuring that every dollar collected goes towards making the community a better place to live, learn, and thrive.

While the journey ahead is undoubtedly loaded with challenges and a few nerve-racking moments, the progress made so far is super important and provides hope for a future where tax revenue not only fills state coffers but also builds a robust foundation for long-term community prosperity.

For residents, lawmakers, and observers alike, the case of Arizona’s marijuana tax revenue stands as both an inspiration and a call to action: to keep making your way through the small distinctions and hidden complexities of new policy frontiers, and to work together in charting a path toward a more equitable and sustainable future.

Originally Post From https://www.newsbreak.com/news/3850084029503/arizona-collected-25-million-in-marijuana-tax-revenue-in-february-nearing-1-billion-all-time

Read more about this topic at

Massachusetts Recreational Marijuana Sales Hit $7 Billion …

Cannabis Industry Milestones & Regulation Changes in 2024